How to File Income Tax Return (ITR) Online in 2026?

In India, it is that time of the year again when everyone is busy filing their income tax returns. To ease the process, the Income Tax Department provides taxpayers with the convenience of filing their returns online.

The return filing process has become much easier because of the updated e-filing portal. However, it is extremely important for all taxpayers to understand the step-by-step procedure for filing ITR online. Read on to know more about it.

A step by step Guide on How to e-file Income Tax Returns on the Portal

Calculate your income tax liability as per the provisions of the income tax laws. Use your Form 26AS to summarise your TDS payment for all 4 quarters of the assessment year. On the basis of the definition provided by the Income Tax Department (ITD) for each ITR form, determine the category that you fall under and choose an ITR form accordingly.

Follow the steps mentioned below to e-file your income tax returns using the Income tax e-filing portal:

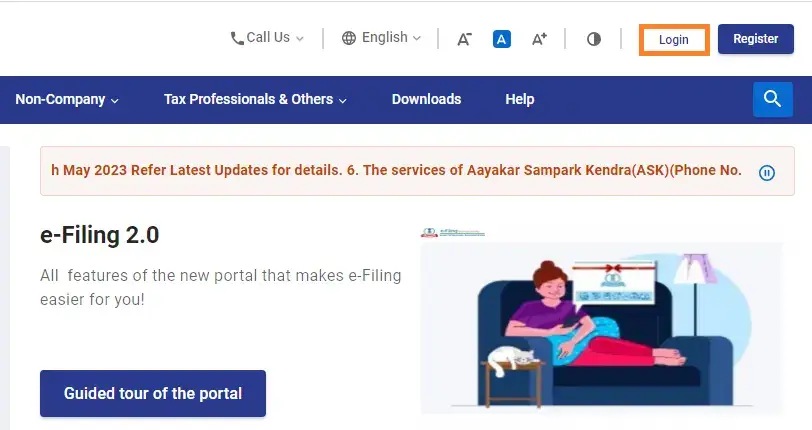

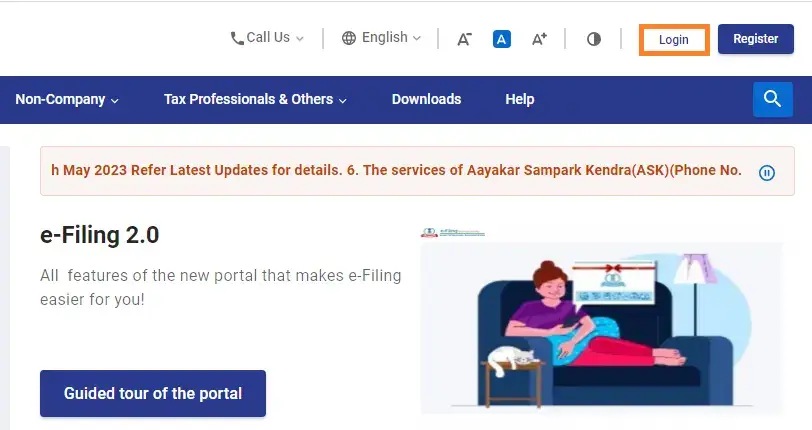

Step 1: Visit the official Income Tax e-filing website and Click on the 'Login' button. If you're a new user click on 'Register' button.

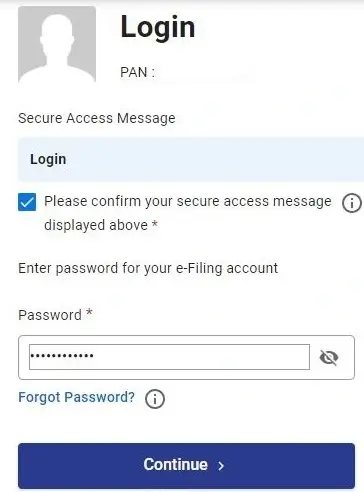

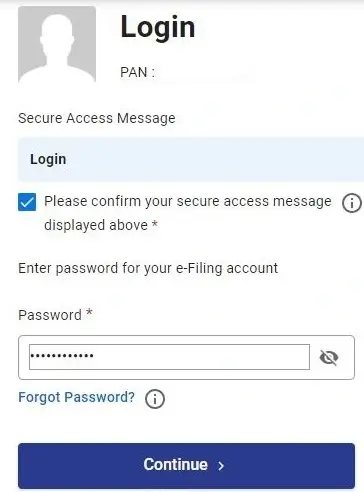

Step 2: Next, Enter your Username (PAN) , then click on 'Continue' After entering your Password.

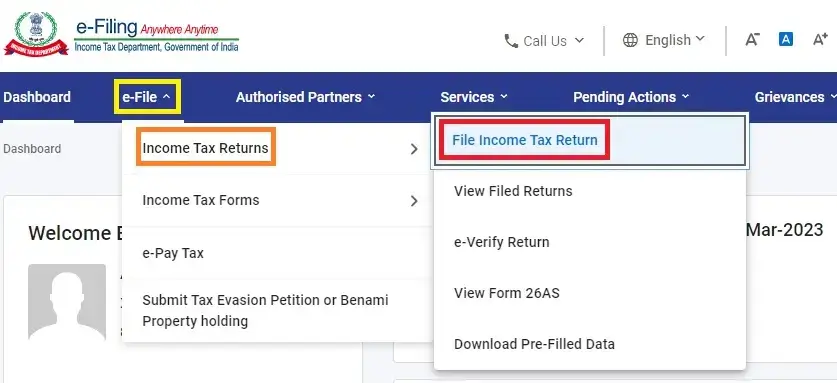

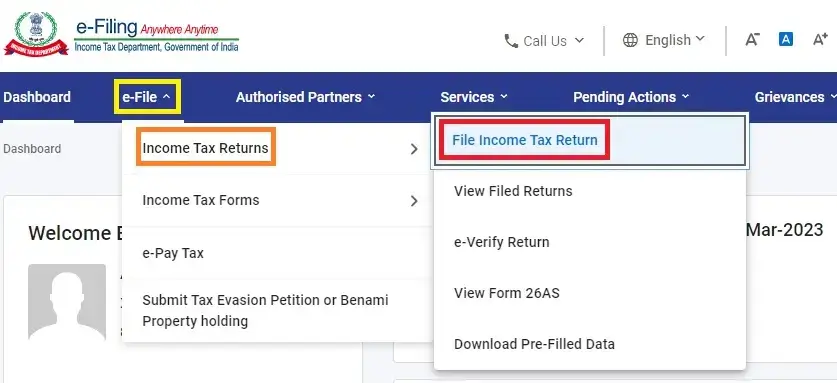

Step 3: Once you have logged into the portal, click on the tab 'e-file' and then click on 'File Income Tax Return'.

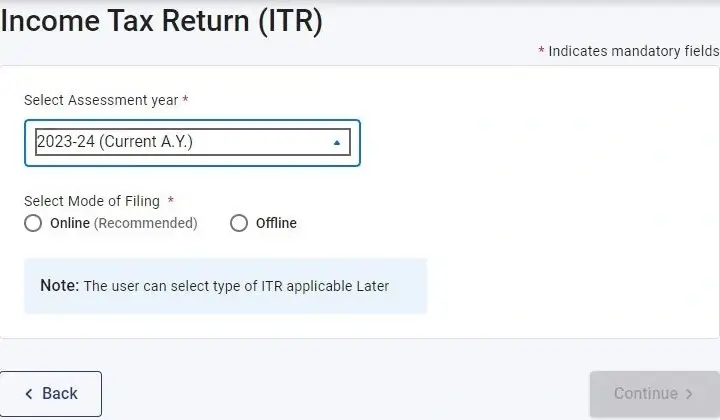

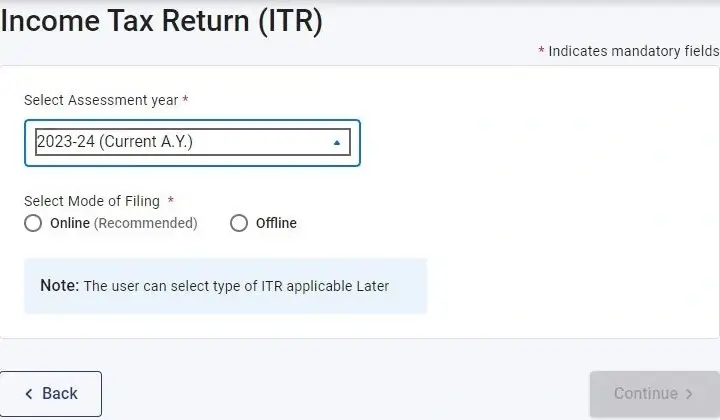

Step 4: Select the 'Assessment year' and 'Mode of Filing' for which you wish to file your income tax returns and click on 'Continue'.

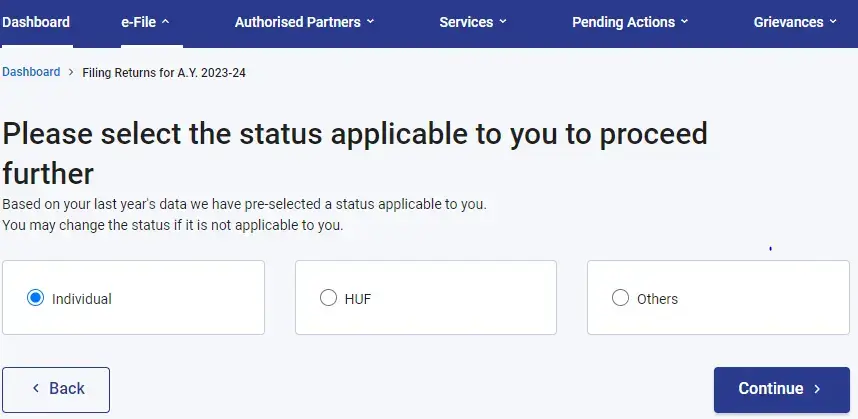

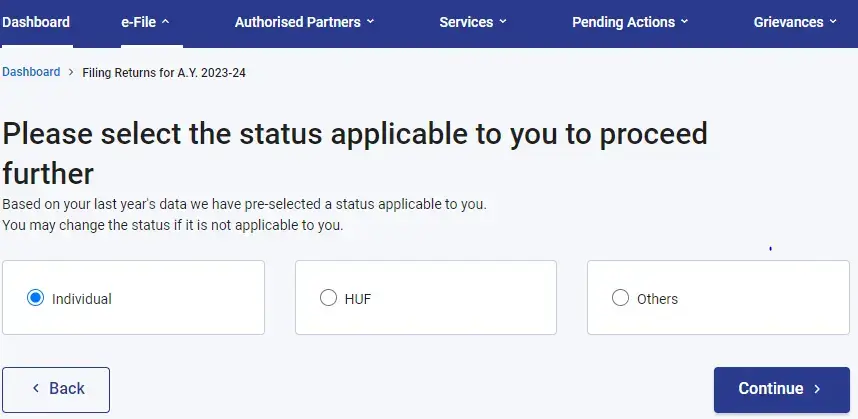

Step 5: Choose whether you wish to file your income tax returns as an Individual, Hindu Undivided Family (HUF), or others. Choose the option 'Individual'. Then, Click on 'Continue'

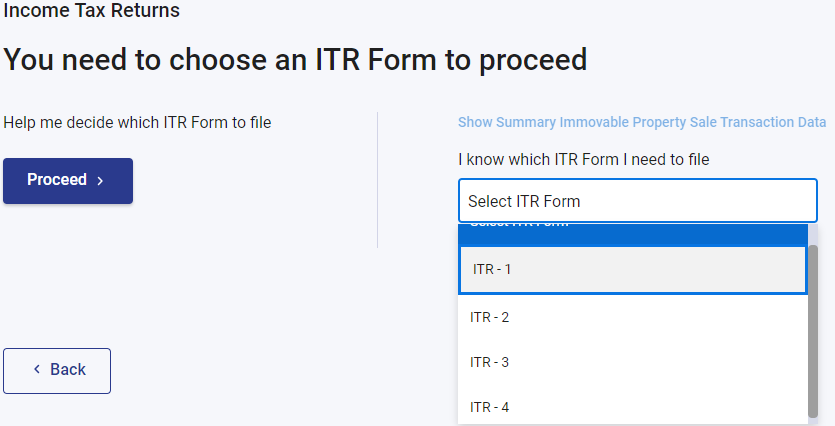

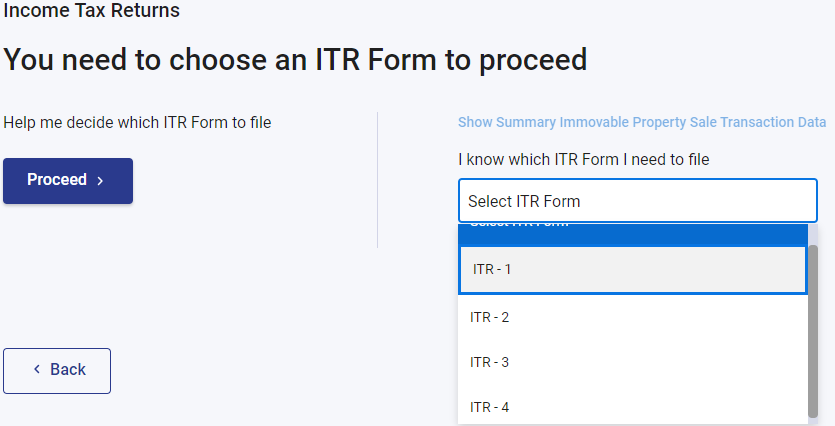

Step 6: Now, Choose the income tax returns (ITR) you wish to file. For example, ITR 2 can be filed by individuals and HUFs who don't have income from business or profession. Similarly, in case of an individual, they can choose the option ITR1 or ITR4. Here you will have to click 'Proceed with ITR1'.

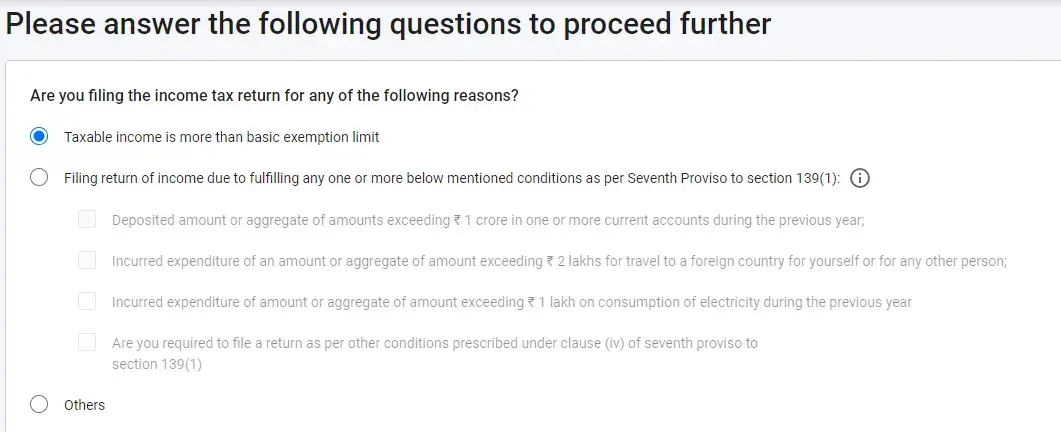

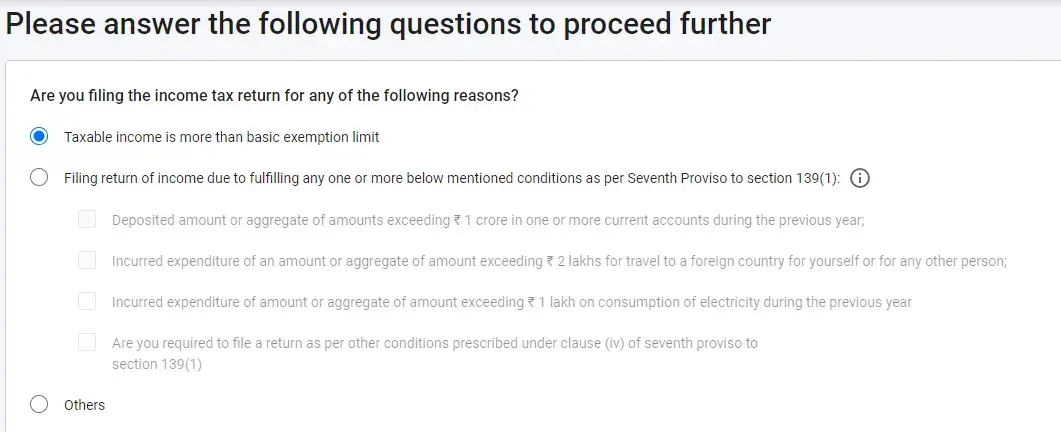

Step 7: The next step will ask you the reason for filing your returns above the basic exempted limit or because of the seventh provision under Section 139(1).

According to the section, if the aggregate amount deposited by an individual exceeds Rs.1 crore in one or more current accounts during the year, exceeds Rs.2 lakh on a foreign trip, or if a payment of more than Rs.1 lakh is paid on electricity bills, then the person can file their income tax returns. Make sure you choose the right option.

Step 8: Fill in the details like if any extra income, investments made and then click on continue

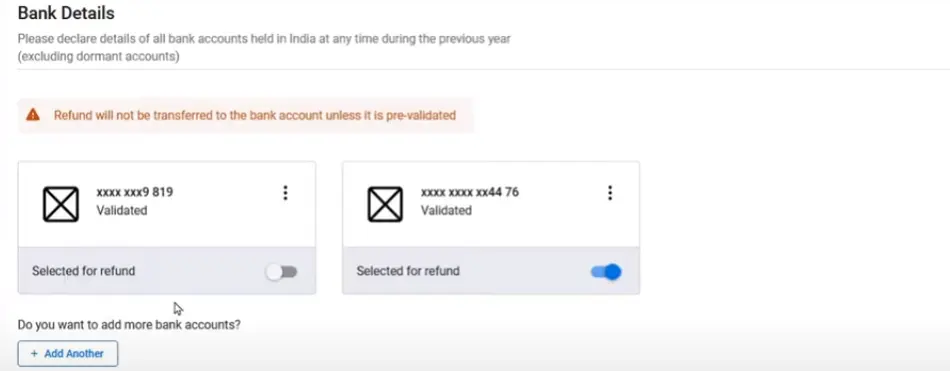

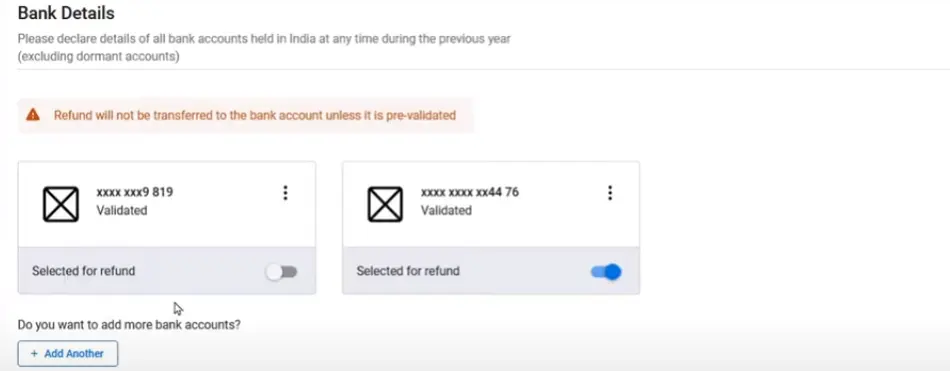

Step 9: Fill in the details of your bank account. If you have already provided the details of your bank account, then pre-validate it.

Step 10: All your personal details, like name, Aadhaar card, PAN card, date of birth, and contact information, will be displayed on the screen. You need to check these details and confirm them.

Step 11: The last step in e-filing your ITR is verifying it. It is important to e-verify your ITR within the time limit of 30 days. If you fail to e-verify your ITR, it is equivalent to not filing it at all.

Documents required for filing ITR

The below- listed documents are required to file ITR:

- PAN card

- Aadhaar card

- Statement of bank accounts

- Receipts in case of donations made

- Trading statement of the stock from the broker platform

- Aadhaar registered mobile number

- Interest certificates from bank

- Receipts related to paid premiums of insurance policy (Life and Health)

How to Login or Register on the e-filing Portal?

Follow the steps given below to register on the e-filing portal:

Step 1: Visit the e-filing portal and click on the ‘Register’ option.

Step 2: You will have to provide your PAN number to register yourself and click on the ‘Validate’ option. If your PAN number is already registered, it will display accordingly on the screen.

Step 3: Fill in all the mandatory details required like name, date of birth, residential status, etc., and click on ‘Continue’.

Step 4: Once the PAN is validated, you will have to submit your contact details on the page. Click on ‘Continue’.

Step 5: You will receive two separate OTPs, one on your registered email ID and one on your registered mobile number. Fill in the OTPs and click on ‘Continue’. Do note that OTPs received will be valid for 15 minutes only.

Step 6: Check all the details displayed on the page and see if you need to edit any of them. If all the details mentioned are accurate, click on ‘Continue’.

Step 7: Fill in your desired password in the ‘Set Password’ textbox and type the same in ‘Confirm Password’ textbox.

Step 8: Once the password is set and you have successfully registered, you can login on the portal.

Step 9: Click on ‘Proceed to Login’. Enter your credentials and password to log in on the portal.

Guide on How to File ITR offline for Super Senior Citizens

Citizens aged between 60 and 80 years are senior citizens, while super senior citizens are those aged above 80 years. As per the old tax regime, the senior citizens and super citizens are eligible for a concession in tax rates.

However, there is no such concession under the new tax regime. Senior and super senior citizens can choose to pay tax under either regime based on which is more beneficial to them. It is important to note that non-resident senior citizens are not eligible for these concessional tax slabs, and the standard income tax provisions will apply to them irrespective of the age.

The procedure to file returns offline is mentioned below:

The Income Tax Department provides the facility to resident super senior citizens (aged 80 years or above), who are not generating any income from business or profession, to file their ITR offline in paper form instead of filing it electronically. They can use ITR-1 (Sahaj) or ITR-4 (Sugam) form to complete the return filing process.

Follow the steps mentioned below to file a return offline:

Step 1: You can obtain the ITR-1 or ITR-4 form manually from the Income Tax Department.

Step 2: Fill in all the required details and complete all the tax calculations.

Step 3: Attach the required documents (if any). You will have to attach Form 16 (if applicable) and proof of deductions claimed.

Step 4: Submit the physically signed copy of your ITR to the Income Tax Department.

Step 5: You will receive an acknowledgement receipt on submitting the ITR. Save it for the future reference.

ITR filing - Common Mistakes to Avoid while filing your Income Tax Return

Given below are the common mistakes while e-filing income tax status:

- Choosing Wrong ITR Form

ITR forms differ based on the taxpayer’s income and source. For example, ITR-1 is meant for resident individuals earning up to ₹50 lakh from salary, one house property, or other sources.

ITR-3 applies to business owners and professionals, while ITR-4 is for those opting for presumptive taxation, like freelancers. Filing the return in the wrong form may render it invalid, prompting a notice to refile correctly.

- Non-Verification of TDS Details with Form 26AS

The form 26AS comprises a summary of TDS as well as tax payments on the income tax like interest, salary, or sale of an immovable property. The taxpayers should verify the TDS as well as tax payments before filing form 26AS.

- Quoting Wrong Assessment Year

It is mandatory to provide correct assessment year while filing the income tax returns. If you mention the wrong assessment year, you might have to pay double tax which can attract penalties.

- Non-declaration of all bank accounts

The Taxpayer needs to declare all their bank accounts in India except dormant accounts. As a taxpayer you need to choose your bank account in which you want to get the refund.

- Non reporting Capital Gains on Sale of Assets

The ITR needs complete details of the sale of capital assets, expenses and purchase in calculating the capital gain. When a taxpayer invests in order to claim a capital gains exemption, the investment and exemption facts must be disclosed.

- Filing ITR without Using All Income Sources

While filing ITR, it is crucial to report all income, whether from current or past employment or investments, under the correct form. Omitting income, especially from previous jobs, can lead to mismatches in Form 26AS or TDS certificates and may result in a tax demand notice with additional dues.

- No Clubbing of Income of a Minor

If the taxpayers have made any investment in the name of the minor, he or she needs to include the income like interest earned as a part of the income. The clubbing of interest is mainly with the parent whose income is higher. You can claim a tax deduction of up to Rs.1,500 per minor for up to two children.

A step by step Guide on How to e-file Income Tax Returns on the Portal

Calculate your income tax liability as per the provisions of the income tax laws. Use your Form 26AS to summarize your TDS payment for all 4 quarters of the assessment year. On the basis of the definition provided by the Income Tax Department (ITD) for each ITR form, determine the category that you fall under and choose an ITR form accordingly.

Follow the steps mentioned below to e-file your income tax returns using the Income tax e filing portal:

Step:1

Visit the official Income Tax e-filing website and Click on the 'Login' button. If you're a new user click on 'Register' button.

Step 2:

Next, Enter your Username (PAN) , then click on 'Continue' After entering your Password.

Step 3:

Once you have logged into the portal, click on the tab 'e-file' and then click on 'File Income Tax Return'.

Step 4:

Select the 'Assessment year' and 'Mode of Filing' for which you wish to file your income tax returns and click on 'Continue'.

Step 5:

Choose whether you wish to file your income tax returns as an Individual, Hindu Undivided Family (HUF), or others. Choose the option 'Individual'. Then, Click on 'Continue'

Step 6:

Now, Choose the income tax returns (ITR) you wish to file. For example, ITR 2 can be filed by individuals and HUFs who don't have income from business or profession. Similarly, in case of an individual, they can choose the option ITR1 or ITR4. Here you will have to click 'Proceed with ITR1'.

Step :7

The next step will ask you the reason for filing your returns above the basic exempted limit or because of the seventh provision under Section 139(1).

Step 8:

Fill in the details like if any extra income, investments made and then click on continue.

Step 9:

Fill in the details of your bank account. If you have already provided the details of your bank account, then pre-validate it.

Step 10:

You will then be directed to a new page to file your income tax returns. The page will contain a lot of information filled already. Check them make sure all the details mentioned are correct. Confirm the summary of your returns and validate it.

Step 11:

The final step is to verify your returns and send a hard copy of if to the Income Tax Department. The verification process is mandatory.

FAQs on How to file ITR

- What are the different forms that are available as per the Income Tax Law?

The different forms that are available as per the Income Tax Law are ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, ITR7 and ITR-V.

- Should I attach any documents when I file the income tax returns?

No, you need not submit any documents when you file the income tax returns. However, the relevant documents must be retained and must be provided to tax authorities if requested.

- Will I face any criminal prosecution in case the tax returns for my taxable income is not filed?

Yes, in case the tax is not paid, you may have to pay additional interest, penalties, or may face prosecution. Depending on the amount of tax that must be paid, the prosecution will vary.

- Can I file an income tax return after the deadline?

Yes, you can file ITR after the deadline through an updated return.

- Will I have to submit any documents when e-filing my ITR?

No, you will not have to submit any documents when e-filing your ITR.

News about Filing ITR

Central Board of Direct Taxes Has Announced New Deadline for ITR Filing

Taxpayers have now been granted additional time to file their income tax returns for the financial year 2024-25. Earlier the deadline was 31 July 2025 but now it has been pushed forward to 15 September 2025.

This change has been made to allow the Income Tax Department to carry out key updates to the ITR forms and the e-filing system. The new versions of the forms are aimed at making the filing process simple and error-free. The revised timeline will be helpful for salaried individuals by giving them 46 extra days to complete the process. However, if a return is not filed by this new deadline, the taxpayer may face a late fee of up to Rs.5,000 under current income tax rules.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.