House Rent Allowance (HRA)

HRA, or House Rent Allowance, is a wage given by employers to staff members to cover housing costs associated with leasing a home. The HRA is a crucial part of a person's pay. Both salaried and self-employed people are covered by HRA.

According to rule 2A of the Income Tax Rules, HRA for salaried individuals is accounted for under section 10 (13A) of the Income Tax Act.

Similar to this, self-employed people are not taken into account for HRA exemption under this provision but may still be eligible for tax benefits under section 80GG of the Income Tax Act. If you have opted for the new tax regime then you cannot avail tax exemption of house rent allowance. HRA is available only under the old tax regime.

House Rent Allowance for Salaried and Self-Employed Individuals

- Salaried individuals are eligible to claim exemptions for HRA under Section 10 (13A), rule number 2A of the Income Tax Act.

- Self-employed individuals are not eligible to claim HRA under the rules of the Income Tax Act. However, they are eligible to receive tax deductions under Section 80GG for rental housing.

How is House Rent Allowance (HRA) Calculated?

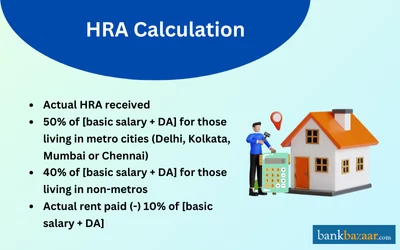

Salaried employees are eligible for HRA exemption for the income tax that they are required to pay each financial year. As per the Income Tax Act, for the calculation of house rent allowance, the least of the following three components is taken into consideration -

- Actual HRA received by the employer

- 50% of your basic salary if you live in a metro city (Delhi, Kolkata, Mumbai or Chennai), 40% if you live in a non-metro city.

- Rent paid minus 10% of basic salary

Where, basic salary refers to basic + DA + commission on sale at fixed rate.

Documents Required to Claim Tax Exemption on HRA

The following documents need to be submitted to claim tax exemption on HRA:

Proof of rent payment: The main document that has to be provided at the time of claiming tax exemption for HRA is the rent receipts to the rental agreement. You will need to provide bank statements if you do not have rent receipts. Being a taxpayer, you will be eligible for this exemption even if you are paying rent to your parents.

Bank Statements: You will need to provide bank statements if you do not have rent receipts along with your rental agreement.

PAN card of your landlord: As the taxpayer, you will have to submit your rent receipts to avail of tax exemption on HRA. The PAN Card details of the landlord/landlady are required to be provided as well in the cases where the annual rent of the housing unit exceeds the mark of Rs.1 lakh.

Self-declaration form: If the landlord/landlady does not have a PAN card, he or she can provide a self-declaration quoting the same.

What are the Exemption Rules of HRA?

Some of the most prominent rules pertaining to house rent allowance are mentioned below.

- For those who reside in non-metropolitan areas, 40% of the base pay is determined as HRA; for those who reside in metropolitan areas, the amount is 50%.

- In order to avail HRA benefit it is not necessary that you pay rent only to a landlord. Individuals can pay rent to their parents and show relevant receipts to claim HRA exemption.

- However, you cannot claim HRA exemption by showing that you pay rent to your spouse. This is not permissible under the income tax law.

- Rent receipts need to be submitted as proof in order to avail tax exemption benefit.

- PAN card details of the landlord need to be furnished so that relevant tax deductions can be made from his/her income from property (rent received).

- PAN details of landlord are required only if the rent paid exceeds one lac rupees per annum.

- Employees who live in their own homes yet receive HRA are still subject to income tax.

How to Claim HRA Exemption When Filing Your Tax Returns

- If the rent paid in a financial year is more than Rs. 1 Lac, people must submit their rent receipts along with the landlord's PAN information in order to file an HRA or home rent allowance claim.

- According to a related circular, the Income Tax department has several technical platforms through which it can verify the information provided by tax payers in the event that the landlord does not have a PAN number. Therefore, making up information is never a good idea.

When is a Landlord's PAN Required?

If you live in a rented house where the annual rent amount exceeds Rs.1 lakh then you will have to submit the PAN card details of the house owner. In case the owner does not have a PAN card then a self-declaration stating they do not have PAN must be signed as per Circular No. 8/2013.

HRA Calculation Example: Metro City Scenario

Jason is earning an income of Rs.3 lakh annually. He pays a rent of Rs.5,000 per month which is Rs.60,000 annually. In such case the deduction will be as follows:

- Monthly rental limit of Rs.5,000 per month which is Rs.60,000 annually.

- Rent paid which is Rs.60,000 minus 10% of the total adjusted income which is 30,000 which amounts to Rs.30,000

- 25% of the total annual income which is Rs.75,000

In this case, the second condition is satisfied, hence an HRA of Rs.30,000 can be claimed.

HRA Calculation Example: Non-Metro City Scenario

Anwar is earning an income of Rs.8 lakh annually. He pays a rent of Rs.10,000 per month which is Rs.1.2 lakh annually. In such case the deduction will be as follows:

- Monthly rental limit of Rs10,000 per month which is Rs.120,000 annually.

- Rent paid which is Rs.120,000 minus 10% of the total adjusted income which is 80,000 which amounts to Rs.40,000

- 25% of the total annual income which is Rs.2 lakh

In this case, the condition number 2 is satisfied, hence an HRA of Rs.40,000 can be claimed.

How to Claim HRA When Living with Parents

Let’s say you work in an MNC and reside with your parents in their house despite receiving HRA from your employer. To claim this allowance, you can sign a rental agreement with your parents and send money to them each month. Your parents must include your rent payment as income on their income tax return.

If their other income is taxable at a lower tax slab or is less than the basic exemption limit, they will save tax on the family income. Essential elements of this arrangement are as follows:

- Rental agreement

- Payment of the rent, ideally through a bank transfer

- ITR filing by parents to report their rental income

How to Claim Deduction Under Section 80GG

In order to claim deduction under Section 80GG of the Income Tax, the lowest of the following will be taken into account:

- Rs.5,000 per month

- 25% of the adjusted total income

- Actual rent which is 10% less of the adjusted total income

Adjusted Total Income is the total income minus the long-term capital gains, and short-term capital gains under section 111A, section 115A or 115D and deductions from sections 80C to 80U.

What to Do If You Do Not Receive HRA?

If your employer doesn’t pay your HRA, despite you living in a rented accommodation, you can still claim the deduction from your taxes as per Section 80GG. However, to claim this, certain conditions must be fulfilled which are mentioned below -

- You are a salaried/self-employed person

- You, your spouse, your minor child, or the HUF of which you are a member do not own any residential property where you now reside, perform official or employment-related activities, or conduct business or practice your profession.

- You have not received any HRA allowance in a year.

How to Avail Tax Benefits on Your Home Loan and HRA?

Tax benefits on HRA are applicable as long as you are paying rent for your accommodation. However, you can avail of tax benefits on your home loan as well as HRA tax benefits in case your own home is rented out and you are staying at a rented place. However, in such a case you need to disclose your rental income or income from the property from which suitable tax will be deducted by the government.

If the owned and the rented property are in the same city then tax exemption on both cannot be claimed. However, if any individual can prove that the owned property is quite far from the place of work and hence the rented accommodation has been availed, then tax exemption on both HRA as well as housing loan can be claimed.

FAQs on House Rent Allowance (HRA)

- How do I claim HRA on my tax return (ITR)?

The taxable portion of the HRA component should be included in the 'Salary as per Section 17(1)' calculation. An exempt category is to be added under the heading ‘allowances to the extent exempt u/s 10’.

- How to Claim HRA when living with Parents?

One approach to claim HRA while living with your parents is to enter into a rental agreement with them under which you agree to pay a set amount of rent to them each month. You may deduct the sum from your taxes by claiming it as HRA when you file your income taxes.

- How do I claim HRA if not mentioned in Form 16?

If your Form 16 does not mention the HRA category, it means the component has not been provided by your employer.

- Does House Rent Allowance fully exempt from taxation?

No, the House Rent Allowance (HRA) is not fully exempted from taxation, only a part of HRA is exempted along with certain limitations.

- Can I claim HRA while living with my parents?

Yes, you can claim HRA while living with your parents. However, for this you have to enter a rental agreement with your parents where you agree to pay certain amount as rent to them.

- Can a self-employed person be qualified for HRA exemption?

No, a self-employed person cannot claim House Rent Allowance (HRA) exemption because HRA is a component of salary and is applicable only to salaried individuals receiving HRA from their employer.

- Which category of income tax does HRA falls under?

The HRA falls under the Section 10 (13A) of income tax.

- If HRA is not stated in Form 16, how can I claim it?

A separate component of HRA has not been supplied by your employer if HRA is not listed in Form 16. When the employer contributes a distinct component to HRA, HRA under section 10(13A) may be claimed. You may claim for rent paid under Section 80GG in the absence of it.

- Will my HRA vary if I shift from a normal city to a metropolitan city?

Yes. HRA is dependent upon the city in which you stay. Moving from a non-metro city to metro would change your HRA from 40% to 50% of your basic salary.

- What are the documents required to claim HRA Exemption?

You are required to submit PAN Card, Rent receipt and Photocopy of rent agreement if required.

- Can I claim HRA Exemption and Home Loan Tax Exemption both?

Yes. You can claim both tax exemptions if you are able to furnish sufficient proofs for the same.

- Can I pay rent to my father to avail HRA benefit?

Yes. You can pay rent to your father in order to avail tax exemption of HRA.

- What happens if the city of residence and that of work is different?

In such a case, place of residence will be considered for HRA calculation and not place of work.

- What if the employer refuses to allow the HRA Tax Benefit?

You need not worry in case your employer refuses to allow tax benefit. You can claim the same while filing your tax return and can receive the exempted amount as refund of excess TDS.

- Can both working spouses claim HRA Tax benefit separately?

Yes. If both of them are paying rent to the landlord and both can furnish separate receipts. However, there should not be duplication which might lead the income tax department to deduct twice the tax from landlord's income from property.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.