Sukanya Samriddhi Yojana (SSY) - 2026

What is Sukanya Samriddhi Yojana (SSY)?

Sukanya Samriddhi Yojana (SSY) is a National Savings Scheme offered by the Government of India under the Ministry of Finance. which is specially designed for girl child. It offers one of the highest rates of interest among small savings schemes backed by the Government of India. The rate of interest for Sukanya Samriddhi Yojana for the financial year 2025-2026 is 8.2% per annum, which is compounded annually.

Table of Contents

- Sukanya Samriddhi Yojana Details

- Sukanya Samriddhi Yojana Eligibility

- Benefits of Sukanya Samriddhi Yojana Scheme

- Features of Sukanya Samriddhi Yojana

- Formula to Calculate the Interest Earned on SSY

- Documents Required to open an SSY account

- How to open a Sukanya Samriddhi Account?

- Conditions for Non-Payment of Sukanya Samriddhi Interest

- What happens if Lesser or Excess Amount is Paid towards Sukanya Samriddhi Yojana scheme?

- Sukanya Samriddhi Yojana Withdrawal Rules

- Rules for Premature Withdrawal from SSY Account

- Tax Benefits on Sukanya Samriddhi Yojana

- How to Fill an SSY account Form for post office?

- How to pay for SSY Online?

- What are the Details Recorded in the Passbook?

- How to Fill Sukanya Samriddhi Yojana Application Form

- How to Transfer Sukanya Samriddhi Account from Post Office to Bank?

- Sukanya Samriddhi Yojana Closure Rules

SSY can be opened through Post Offices, public sector banks, and three private sector banks : HDFC Bank, ICICI Bank, and Axis Bank.

The following are the primary targets of the Sukanya Samriddhi Yojana scheme:

- Ensures the protection and the survival of girls.

- Ensures that more girls participate in education and other areas.

- Ensures reduction in the practice of determining sex and gender discrimination against children.

Sukanya Samriddhi Yojana Details

Here some other important details of the SSY scheme:

Interest rate | 8.2% p.a. |

Investment Amount | Minimum - Rs.250, Maximum Rs.1.5 lakh p.a. |

Maturity Amount | Depends on the invested amount |

Maturity Period | 21 years (or, till the girl is married after attaining the age of 18 years) |

Sukanya Samriddhi Yojana Eligibility

The Sukanya Samriddhi Yojana account eligibility are mentioned below:

- The parent or legal guardian can open an Sukanya Samriddhi Yojana account on behalf of a girl child until she reaches the age of 10.

- The girl child must be a resident Indian.

- In a family, up to two accounts can be opened for two girls.

- A third SSY account can be opened in case of twin girls.

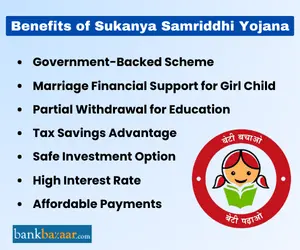

Benefits of Sukanya Samriddhi Yojana Scheme

Sukanya Samriddhi Yojana (SSY) scheme was launched under the Beti Bachao Beti Padhao campaign with the main aim of securing the future of a girl child.

- Affordable Payments: The minimum account balance required to maintain an Sukanya Samriddhi Yojana account is Rs. 250 per fiscal year. You have the flexibility to make deposits up to Rs. 1.5 lakh per fiscal year, making it accessible for people from all sections of society. Even if you miss a payment for a year, a penalty charge of Rs. 50 will be levied on the minimum payment of Rs. 250, but the account will continue.

- Educational Expenses Covered: You can withdraw 50% from the balance present in the account as of the previous financial year's end to cover the educational expenses of your girl child. This can be availed by providing proof of admission.

- Attractive Interest Rates: Sukanya Samriddhi Yojana accounts offer high-interest rates compared to other government-backed schemes. Currently, the rate stands at 8.2% p.a.

- Guaranteed Returns: As Sukanya Samriddhi Yojana is a government-backed scheme, there is an assurance of returns upon maturity.

- Convenient Transfer: You can easily transfer the Sukanya Samriddhi Yojana account from a bank to a post office or a post office to a bank anywhere in India.

- Tax benefits: To encourage investments in SSY, the scheme offers the following tax benefits,

- Section 80C Deductions: Investments made in the SSY scheme can be deducted under Section 80C of the Income Tax Act up to a maximum cap of Rs. 1.5 lakh.

- Tax-Exempt Interest: The interest that accrues on the Sukanya Samriddhi Yojana account, compounded annually, is exempt from tax under Section 10 of the Income Tax Act.

- Tax-Free Proceeds: The proceeds received upon maturity or withdrawal from the SSY account are also exempt from income tax.

Features of Sukanya Samriddhi Yojana

The main features of the Sukanya Samriddhi Yojana account are listed in the table below:

Features | Details |

Operation of the account |

|

Deposits made towards the account | The minimum and maximum deposit that can be made in an account in a financial year is Rs.500 and Rs.1.5 lakh, respectively. The deposits can be made in multiples of 100. |

Duration of the scheme | Deposits towards the scheme should be made for a period of 15 years. However, the scheme matures after 21 years. |

Transfer of account | An SSY account can be transferred from post offices to banks and vice versa anywhere within India. No charges will be levied for the transfer of the account. However, a proof for change in residence must be produced. In case no proof is produced, a Rs.100 charge will be levied. |

Mode of deposits | Deposits towards the account can be made in the form of online transfer, demand draft, cheque, or cash. |

Formula to Calculate the Interest Earned on SSY

The Sukanya Samriddhi Yojana Calculator helps an individual to get an estimate of the investment plan under the SSY scheme.

The calculator will use the details such as the investment made every year and the rate of interest mentioned by you to evaluate the data and give you the end result in terms of the maturity amount.

The interest calculation for SSY follows a specific method. The interest is calculated based on the lowest balance in the account between the fifth day and the last day of the calendar month. The interest is credited once at the end of each financial year.

To calculate the interest earned on an SSY account, you can generally use the following formula:

A = P(1 + r/n)^(n*t)

Where:

P = Initial deposit

r = Rate of interest

n = Number of times interest is compounded in a year

t = Number of years

A = Amount at maturity

Documents Required to open an SSY account

The documents required to open an SSY account are listed below:

- Sukanya Samriddhi Yojana account-opening form.

- The ID proof and address proof of the depositor must be submitted at the time of opening the account.

- A medical certificate must be submitted in case multiple children are born under one order of birth.

- Any other documents requested by the bank or post office.

- The birth certificate of the girl child must be submitted at the time of opening the account.

Birth certificate is one of the important documents that is needed in order to open a Sukanya Samriddhi Account but since there is a possibility many people might not have the certificate, the government has chalked out alternative through which the account can be opened. The parents or legal guardians of the girl child can submit these documents as alternatives in the absence of the birth certificate.

- A certificate issued by the Headmaster of the school verifying the date of birth of the girl child

- A certificate issued by the hospital where the girl child was born verifying the date of birth of the girl child

- Passport of the girl child

- PAN Card of the girl child

- Aadhar Card of the girl child.

How to open a Sukanya Samriddhi Account?

Given below are the steps you will have to follow to open a Sukanya Samriddhi Account:

- Visit the nearest branch of the bank or post office and fill the application form.

- Once you have filled in the form, submit it along with all the necessary documents.

- Pay the first deposit amount which can range between Rs.250 and Rs.1 lakh.

- The application form and payment will be verified by the bank or the post office and if all the details are correct, an SSY account will be opened in your name.

Conditions for Non-Payment of Sukanya Samriddhi Interest

The following are the instances when SSY account does not accrue interest:

- Make a minimum deposit of Rs.250 per year to keep the account active.

- A penalty of Rs.50 will have to be paid, in case the account becomes inactive due to non-payment of minimum deposit and interest will not be paid if penalty is not paid.

- Reduced rate of interest will be offered the entire amount of the deposit in such cases

- Interest rate of savings account which is lower than SSY would apply

- Extra interest amount paid before default will be deducted from balance amount

- After five years of opening the account, premature closure of account is allowable

- This premature withdrawal is allowed only in case of a medical emergency or a life-threatening condition

- The SSY interest rate would not apply if premature closure is done for any other reason

- Savings account interest rate would be applied only

What happens if Lesser or Excess Amount is Paid towards Sukanya Samriddhi Yojana scheme?

- Lesser amount: In case the minimum amount of Rs.500 is not paid in a financial year, the account will be considered as default. However, the account can be brought back to the active status by paying a fine of Rs.50.

- Excess amount: No interest is generated for any deposit above Rs.1.5 lakh. The depositor can withdraw the excess amount at any time.

Sukanya Samriddhi Yojana Withdrawal Rules

The withdrawal rules of the SSY account are mentioned below:

- Once the account's duration is completed, the entire amount available in the account, including the interest, can be withdrawn by the girl child. However, the below-mentioned documents must be submitted:

- Application form for the withdrawal of the amount.

- ID proof

- Address proof

- Citizenship documents

- Withdrawal is allowed for higher education if the girl child has attained the age of 18 years and has completed 10th standard. However, the money must be used for the fee or any other charges that are levied at the time of admission.

- Documents such as admission to the university or college as well as the fee receipt must be submitted when applying for the withdrawal.

- The maximum amount that can be withdrawn is 50% of the amount that is available in the previous year. The amount can be withdrawn in 5 instalments or in a lump sum.

Rules for Premature Withdrawal from SSY Account

The rules that allow premature closure of the account is mentioned below:

- Once the girl attains the age of 18 years old and is getting married, SSY premature withdrawal is allowed. However, an application must be submitted at least one month before marriage and 3 months after the marriage to avail yourself of the benefit. Documents which determine the age of the girl must also be provided.

- In case the girl child becomes a non-citizen or a non-resident, the account will be deemed as closed. Any such change in status must be informed by the guardian or the girl child within one month from the change in status.

- In case the girl child passes away, the balance that is available in the account can be withdrawn by the guardian. However, the death certificate must be submitted.

- If the account has been opened for 5 years and more, and the bank or post office feel that the continuation of the account is causing difficulties to the girl child, the guardian or girl child can opt for premature closure.

- Permission to close the account will be permitted for other reasons too, but the interest earned from the contributions will be the same as the interest rates provided by post offices.

Tax Benefits on Sukanya Samriddhi Yojana

The following are the Sukanya Samriddhi Yojana tax benefits:

- Sukanya Samriddhi Scheme is a government-backed tax-saving scheme

- Under Section 80C of the Income Tax Act, 1961, tax benefits of up to Rs.1.5 lakh are provided for contributions made towards the scheme.

- The scheme is an EEE (Exempt Exempt Exempt) scheme

- The interest amount as well as the amount received is also exempt from tax.

- The scheme ensures tax-free corpus for your daughter

- The scheme offers the highest interest rate among other small saving schemes despite the reduction in interest rate

- Tax benefits are also provided for the maturity amount or the withdrawal amount.

Learn more about Sukanya Samridhi Yojana tax benefits

How to Fill an SSY account Form for post office?

The following are the steps to fill an SSY account form for post office:

- Visit the nearest post office and ask for an Sukanya Samriddhi Yojana account application form.

- If you have a savings account with the post office, mention your account number.

- Mention the post office branch details and postal address under 'To The Postmaster'.

- Post the photograph of the applicant.

- Mention the name of the applicant and mention the option 'Sukanya Samriddhi Yojana'.

- Provide the relevant information under 'Account Type' and 'Account Holder Type'.

- Mention the amount you will deposit once the account is created.

- Provide other relevant details such as gender, Aadhaar number, PAN, address, etc.

- Sign page 1 to authorise all the information provided.

- In Page 2 section (5), provide details if you wish to set standing instructions for the amount to be deposited to your account.

- Cheque the square box next to SSA stating that no other Sukanya Samriddhi Yojana account has been created.

- Provide the date and signature.

- Provide nomination details.

- Get two witnesses and get their signature in case the applicant is illiterate.

- Provide the place, date and signature at the end of the nomination section.

How to pay for SSY Online?

The following are the steps to pay SSY through online mode:

- Download the IPBB app on your mobile phone.

- Transfer the money from your bank account to your IPBB account.

- Log in to your IPBB account and choose 'Sukanya Samriddhi Yojana' under 'DOP Products'.

- Provide your Sukanya Samriddhi Yojana account number and customer ID.

- Choose the amount you wish to pay and the duration of instalment.

- Once the payment routine has been set up, IPBB will notify you of the same.

- Each time the money is transferred to your IPBB account, you will be notified of it.

What are the Details Recorded in the Passbook?

Once an SSY account has been opened, the depositor will receive a passbook. The following are the details that are mentioned in the passbook:

- Date of account opening

- Minimum deposit amount

- Annual rate of interest

- Name of the account holder

- Date of birth of the account holder

- Guardian name

- Balance amount in the account

- Account number

- IFSC code

The passbook must be submitted to the bank or post office when money is deposited into the account, receiving the interest payment, and at the time of closing the account.

How to Fill Sukanya Samriddhi Yojana Application Form

The following are the steps to fill Sukanya Samriddhi Yojana application form:

- Mention the Post Office or the bank branch and the postal address under ‘To The Postmaster/Manager’

- The applicant’s photograph should be pasted on the right side of the application form

- Mention applicant’s name next to ‘I/We’ as provided in the application form

- Next, also mention the Sukanya Samriddhi Yojana after applicant’s name

- Write the deposit amount both in number and in words

- Select the mode of payment, such as cheque, cash, or DD

- Mention the cheque or DD number along with the date in the form

- Provide the name and date of birth of the girl child (depositor)

- Enter the following details of the guardian:

- Name

- Date of birth

- Aadhar number

- PAN number

- Provide the contact details and the address

- Mention the birth certificate details and the type of account of the depositor

- Mention the details of the KYC documents attached with the application form

- Provide the nomination details

- Sign on the form along with name

- In case the applicant is illiterate, put signature of two witnesses

- At the end of the nomination section, mention the signature, date, and place

How to Transfer Sukanya Samriddhi Account from Post Office to Bank?

The following are steps to transfer the Sukanya Samriddhi account to a bank from the post office:

- Visit the post office where the beneficiary holds an account with

- Inform your transfer intent to the PO executive and submit the duly filled account transfer form

- Submit the passbook and KYC documents along with the transfer form

- The PO executive will discontinue the account upon the request of the beneficiary

- Visit the bank branch where the beneficiary wants their account to be transferred

- Submit all the required documents including the self-attested KYC documents

- New passbook will be provided after the completion of the transfer request

Note:

- For processing the transfer request, the girl child need not visit the PO branch.

- All the formalities can be completed by the guardian.

- The balance transfer of SSY accounts within or outside post offices or banks can be done free of cost.

- Transfer of Sukanya Samriddhi account can be done by providing proof of residence change of either of the beneficiary or their guardian.

- Change of Sukanya Samriddhi account on any other circumstances would require Rs.100

Sukanya Samriddhi Yojana Closure Rules

The following are the two scenarios of account closure under Sukanya Samriddhi Yojana:

Closure on Maturity

- After the attainment of 21 years of the girl child, the account matures

- The maturity value along with interest is paid out to the depositor, the girl child

- The maturity amount will be paid out on submission of proof of residence, identity, and documents of citizenship

Premature Closure

The following are the scenarios under which applicant can apply for premature withdrawals:

- Death of girl child: The balance in the Sukanya Samriddhi Yojana account along with interest amount will be paid on producing the death certificate.

- Marriage of depositor: After attaining 18 years of the girl child, on the purpose of marriage, applicant can apply for premature closure by providing the documents of age proof one month before marriage and three months after marriage.

- Medical treatment: In case of life-threatening diseases of the girl child or death of the guardian, the SSY account can be closed by providing the relevant documents related to the disease or the death certificate of the guardian.

- Change in the status of the girl child: If the girl becomes non-resident or non-citizen of India, the premature closure can be done by informing about the change within one month of the status change.

- Completion of five years of the SSY account: If continuation of the account causes difficulties for the girl child, then account can be closed prematurely by providing satisfactory reason to the post office or the bank.

- Other reasons: The account can be closed prematurely any time after opening the account and the interest earned on the deposit amount will depend on the post office or the bank.

FAQs on Sukanya Samriddhi Yojana

- Who can open Sukanya Samriddhi Yojana?

Any legal guardian or parent of a girl child can open Sukanya Samriddhi Account on behalf of their girl child.

- What is the minimum annual deposit amount required for Sukanya Samriddhi Yojana?

The minimum deposit amount required per annum is Rs.250.

- Where can I open Sukanya Samriddhi Account for my daughter?

Sukanya Samriddhi account can be opened at any of your nearest post offices or at any branch of the authorized banks. These banks include almost all top and most popular public sector and private sector banks like State Bank of India, ICICI, HDFC, Punjab National Bank etc.

- Who can avail Sukanya Samriddhi Yojana?

Only parents or legal guardians of one or more girl child can avail the Sukanya Samriddhi Scheme in the name of their daughter.

- What is the maximum annual deposit amount that can be deposited under the Sukanya Samriddhi Scheme?

The maximum amount that can be deposited under the Sukanya Samriddhi Scheme is Rs.150000 per annum.

- Is the Sukanya Samriddhi Yojana available throughout India?

Yes. Sukanya Samriddhi is a central government scheme and is present in each and every state of the country.

- Can I withdraw money from my Sukanya Samriddhi Account, prematurely?

No. Only a partial withdrawal of up to 50% is allowed and that also when the girl child has attained at least the age of 18 years. This amount can be withdrawn only for higher education or the wedding expense of the girl child.

- Can a Non-Resident Indian avail of the Sukanya Samriddhi Yojana?

As of now, there is no official communication regarding this issue and such NRIs are, for the time being, not covered under the Sukanya Samriddhi Scheme.

- Can I convert my normal bank deposit account to Sukanya Samriddhi Yojana?

No. Currently, the feature of converting a deposit account to Sukanya Samriddhi Account is not available. Sukanya Samriddhi is a special scheme aimed at uplifting the financial status of girls in the country and as such conversion of accounts is not allowed.

- What is the relaxation in the age limit given to girl children under the Sukanya Samriddhi Yojana?

Since the Sukanya Samriddhi scheme is a newly launched scheme, the government does not want few people to miss availing it due to reasons pertaining to age. Hence, any girl child who has attained the age of 10 years, exactly 1 year prior to the launch of scheme is also eligible to avail of the scheme. So, any girl child born between 2nd December 2003 and 1st December 2004 is eligible to avail the Sukanya Samriddhi Scheme.

- What is the taxation process for the amount deposited under Sukanya Samriddhi Yojana?

There is a limit of Rs.1.50 lakh which is exempt from taxation. Any amount above this will not fetch any income tax relief under section 80C of the Income Tax Act.

- How many Sukanya Samriddhi Accounts can I take for my daughter?

Only one Sukanya Samriddhi Account per girl child is allowed. So if you have two daughters, you can avail two separate accounts in both of their names and if you have one daughter then only one account can be availed.

- What happens in the case the girl child who is the beneficiary meets with an unexpected death?

In case of the death of the girl child, Sukanya Samriddhi Account is discontinued and closed and the proceeds are transferred to the guardian or parent of the girl child.

- What happens in case of death of the depositor (guardian or parent of the girl child)?

In case of the death of a legal guardian or parent of girl child, the scheme is either closed and the proceeds are given to the family or girl child. Or, the scheme is continued with the deposited amount until the maturity period and the deposited amount continues to earn interest till the girl child attains the age of 21 years.

- Is the Sukanya Samriddhi Scheme transferable as per location?

Yes, this scheme can be transferred from post office to bank or from one authorized bank to another. This is because there may be times when girl child may require moving due to study or other such situations.

- Should I opt for Sukanya Samriddhi Scheme or s Recurring Deposit Scheme?

Sukanya Samriddhi looks like a recurring deposit scheme in the way it is structured but customers need to understand that unlike recurring deposits, this scheme is aimed specifically at offering financial strength to girl child in the country. Also, the rate of interest offered on this scheme is higher than that being offered by any bank on recurring deposit schemes.

- Do private sector banks also have the authority to open Sukanya Samriddhi Accounts for the public?

Yes. A few major private sector banks like ICICI, HDFC etc. are authorized by the Finance Ministry to furnish and maintain Sukanya Samriddhi Scheme to customers.

- What happens if I do not deposit money in the account?

The account gets deactivated if the minimum amount of Rs.250 is not deposited. However, it can be revived by paying a penalty fee of Rs.50. This scheme's terms have been kept very flexible to ensure maximum participation by people with all kinds of economic status.

- Can both parents claim a tax deduction for the Sukanya Samriddhi deposit amount under section 80C?

No, only one of the parents or guardians can claim tax rebate as per section 80C for the amount deposited under Sukanya Samriddhi.

- Can SSY account be opened online?

No, there is no provision to open an SSY account online.

- Can a person avail of both Sukanya Samriddhi and PPF schemes?

Yes. Sukanya Samriddhi is a scheme aimed mainly at girl child while PPF or Personal Provident Fund is there to help people save for retirement or longer tenures. Both can be availed simultaneously since both have different financial objectives.

- Is there any difference between Sukanya Samriddhi scheme offered by public banks and that offered by private banks?

No, there is no difference in features of benefits. Be it private banks or public banks or post offices, all authorized entities offer the same features and benefits since the scheme is a central government-driven scheme.

- Is there a last date to avail the Sukanya Samriddhi Scheme?

No, there is no last date to avail yourself of the scheme. However, standard tax filing dates will apply to this scheme too for purposes of taxation.

- Will I be issued a passbook under Sukanya Samriddhi Yojana?

Yes. A passbook to track all your transactions will be furnished to all account holders of the Sukanya Samriddhi Scheme. The passbook will carry all personal details like address, name and age details of the account holder. This is a good reference for depositors in case a dispute arises or even in case of transfer of account from one place to another or from post office to an authorized bank.

- Is the maturity amount on withdrawal from the SSY account taxable?

No, the maturity amount on withdrawal from SSY account is exempted from income tax.

- How to check Sukanya Samriddhi Yojana account balance?

You can check the Sukanya Samriddhi Yojana account balance through passbook which will be issued by either post office or bank. You need to visit the bank branch or post office branch to get your passbook updated regarding your account balance.

- How to download the Sukanya Samriddhi Yojana statement?

To download the Sukanya Samriddhi Yojana statement online, make sure to check whether the bank allows you to check the SSY details online. Then request the bank executive to provide the login credentials and log into internet banking to check the account statement on the dashboard.

- How many accounts can be opened in Sukanya Samriddhi Yojana?

You can open only one account per girl child under Sukanya Samriddhi Yojana. But two accounts can be opened for a maximum of two girl children in a family and multiple accounts can be opened in case of twins or triplets.

- How much should I invest in Sukanya Samriddhi Yojana?

In the SSY account, you can invest any amount from Rs.250 up to Rs.1.5 lakh per financial year.

- What is the duration of the Sukanya Samriddhi Yojana account?

The payment duration under Sukanya Samriddhi Yojana is 15 years, while the maturity duration is 21 years.

- What is the frequency of investment allowed under Sukanya Samriddhi Yojana?

The frequency of investment allowed under Sukanya Samriddhi Yojana is flexible, subscribers can either opt for deposit per financial year or small and regular instalment. For the regular installment, the interval between the instalments can be as per your convenience. While you need to make Rs.250 per financial year for 15 years to keep the account active. There is no limit to the number of deposits made per financial year or month.

- Can I take a loan against the SSY account?

No, you cannot avail yourself of a loan against the SSY account as the loan facility is currently unavailable under this saving scheme.

- Can I still invest in SSY even if my daughter and I move to another country?

No, you cannot continue contributing in SSY fund, if you and your daughter move to another country and your daughter loses Indian citizenship.

- How much will be the maturity amount in Sukanya Samriddhi Yojana?

The maturity amount that will be received in Sukanya Samriddhi Yojana depends on the contribution made every year. The scheme also allows 50% withdrawal of funds as premature withdrawal, once the girl attains 18 years of age for the purpose of education or marriage.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.