ICICI Car Loan Status

Tracking the status of your ICICI Bank car loan is simple, quick, convenient, and can be done online, offline, or by calling the customer care number.

Car loan from ICICI Bank can be availed at an interest rate starting from 9.30% with repayment tenure of up to 84 months. The bank offers financing of up to 100% on the car’s on-road price.

Track Status of ICICI Bank Car Loan Application Status

You can track the status of ICICI Bank car loan application by any of the below-given ways:

- Online on the bank’s official website

- Offline by visiting the nearest branch

- Calling the customer support helpline

Below we have explained all the 3 methods of tracking the status of your ICICI Bank car loan application your ICICI Bank car loan application status.

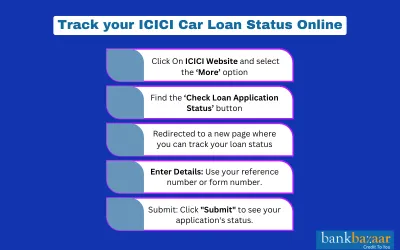

Online Way of Checking ICICI Bank Car Loan Application Status

If you have applied for a car loan from ICICI Bank online on the bank’s official website, you will receive a reference number. Using this reference number, you can track the status of your loan application by following the below-given steps:

- Click on the link on the link which is found in the icici website and select the ‘More’ option to find the ‘Check Loan Application Status’ button.

- You will be redirected to a new page where you can track your loan status.

- Enter your reference number or form number in the space provided and hit on the ‘Submit’ button.

- In case you have forgotten the reference number, you can proceed to the section below that says, ‘Forgot Your Reference Number?’ and then enter the requested details (name, date of birth, product, PAN number, and the loan amount requested).

- Once you click on the ‘Submit’ button, you will be shown the status of your loan application.

Applying for car loan online in a matter of minutes. Check it out here! ICICI Bank Car Loan

Offline Way of Checking ICICI Bank Car Loan Application Status

If you are the kinds who prefer to do things the traditional way, you can visit the nearest branch of ICICI Bank to know the status of your car loan application. You will be asked to provide the loan application reference number (if you have applied for the loan online) or the form number (if you have applied in person) to the bank’s officials after which they will let you know your loan status. You can find your nearest branch by visiting the link - https://maps.icicibank.com/mobile/

Checking ICICI Bank Car Loan Status by Calling Customer Support

You can also track the status of your ICICI Bank car loan by calling the customer support helpline at 1800 1080 (toll-free). Once you call the number and provide your loan reference number, the customer care representatives will find out the status of your loan application and let you know.

Did you know are three types of car loans in India? ICICI Bank Customer Care

FAQs on ICICI Car Loan Application Status

- What are the repayment options available with this car loan?

You can pay the car loan EMIs in a variety of ways. If you are an existing ICICI Bank customer, you can opt for the direct debit facility or ECS. Otherwise, you may also make the EMI payment via issuing post-dated cheques drawn in favour of ICICI Bank Ltd.

- What are some factors which influence the interest rate for a new car loan?

The interest rate for new car loans is dependent on some factors like the tenure of the loan, the car you’re planning to get, and your relationship with the bank, among other factors.

- Will ICICI let me prepay or foreclose my car loan?

Yes, you can prepay or foreclose your car loan at a charge of 5% + GST on the remaining principal loan amount.

- Is there a provision to update my contact details on my ICICI Bank loan account?

Yes, you can easily update your contact details such as your email ID, mobile number, mailing address, etc., by walking into any ICICI Bank branch. When submitting your application, do remember to carry a valid photo ID proof.

- Are used car loan interest rates influenced by any factors?

Yes, interest rates for a used car loan can vary depending on some factors like the age and segment of the car you’re purchasing, the loan product type you are availing – refinance, top-up loan, and the loan term, to name a few.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.