Unit Linked Insurance Plans - ULIPs

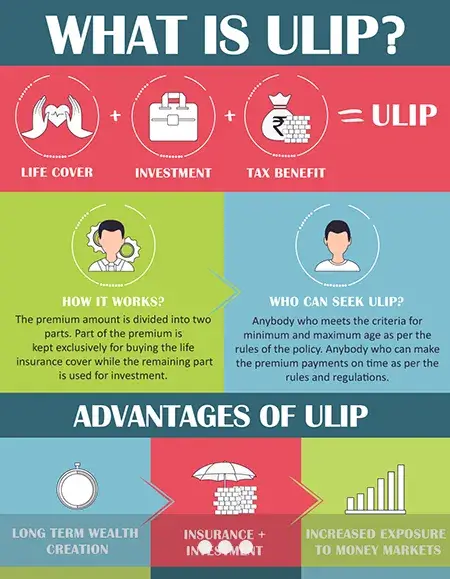

Unit-linked insurance plan is a widely acclaimed investment cum insurance instrument across the globe. Unit-linked insurance plans or ULIPs as they are generally called is an integrated financial product that has features of both insurance as well as investment.

Insurance is a financial product that has quite a few variants depending upon what exactly is being insured and what use will the premium amount be put to. Life insurance plans, health insurance plans, loan insurance plans are some of the most common insurance plans that we come across when we learn about insurance policies.

What is a ULIP?

ULIP is a financial instrument that offers customers best of both the insurance and the investment world. ULIPs are provided by insurance companies to customers who want to avail insurance as well as grow their money while at it.

ULIPs offer customers insurance cover as well as a choice to capitalize on various investment tools like stocks, bonds and mutual funds. The double benefit of protection combined with freedom to choose your investment avenue makes ULIPs a truly popular financial instrument among customers.

Why Should You Buy ULIPs?

A ULIP provides investors with a number of advantages, which are listed below:

- Flexible: ULIPs offer investors the option of switching between funds, resulting in better choices to the investor. Investors can choose to invest in either debt or equity funds depending on their risk appetite and market conditions.

- Risk appetite: ULIPs offer investors to pick choose their investments based on their risk appetite. Low risk appetite investors can choose to invest in debt funds and those who are willing to take a higher risk can opt for equity funds.

- Tax benefits: With ULIPs being life insurance products, they offer tax benefits in the form of tax free maturity. However, this tax benefit depends on the type of ULIP invested, as equity funds could be taxed 15% under certain conditions.

- Low charges: ULIPs do not have high charges associated with them. IRDA has capped the annual charge on ULIPs at 2-2.25% p.a. for the initial ten years, with the charges on par with those of mutual funds.

- Long term investment: ULIPs are a long-term investment option due to the increased lock-in period which also reap bigger returns.

How Do ULIPs Work?

A ULIP or a Unit Linked Insurance Plan is a financial instrument that provides risk cover as well as investment options for the policyholder. ULIPs permit the policyholder to invest in stocks, bonds or mutual funds. The policyholder can choose the investment type based on his risk appetite as all option guarantee returns.

Initially ULIPs did not assure returns and were primarily positioned as a long -term wealth generation product. Nowadays, however, almost all ULIPs offer investors assured returns of double or more their initial investment.

When policyholders invest money in ULIPs, the insurance company invests half in the equity markets (shares, bonds etc.) while the other half is set aside towards providing .

The investments are managed by fund managers from the insurance company, taking away the need to track the investments.

ULIPs allow the policyholder to invest in multiple options, ranging from low-risk to high-risk as the case may be.

ULIPs also allow the policyholder to switch between their investments, allowing them to maximise their gains when market conditions are conducive.

Features of ULIP

ULIPs offer incredible features and benefits to customers and hence are great investment tools especially in today’s fast-paced world where returns matter as much as security. Here are a few highlighting features of unit linked insurance plans that make these instruments stand out among a host of investment options.

Flexibility:

ULIP schemes offer flexibility that is not just applicable to one aspect of the policy but is comprehensive in nature. Following are the kinds of flexibility that you get to avail with your ULIP schemes.

- Life cover can be chosen: Life cover that comes with the insurance part of ULIPs can be chosen by customers depending upon their financial capabilities.

- Premium amount can be changed: After a certain period of time, almost all ULIPs provide their customers option to change the premium amount. This amount can either be increased or decreased by customers depending upon their current financial status. Top-up facility is also offered by most ULIP schemes so that customers who want to maximize their gain can invest higher additional amounts whenever they want.

- Riders can be opted for: Riders are additional benefits that can be availed by paying a marginally higher premium. Examples of such riders are a critical illness rider, major illness rider etc. ULIPs allow customers to avail additional optional riders for added benefits and enhanced protection.

- Fund option can be chosen: ULIPs are insurance policies where a part of your money is put into an investment avenue like mutual funds, stocks, bonds etc. Most insurance providers offer customers the flexibility to choose the fund type in which they want their money to be invested. These funds range from aggressive to conservative variants so as to cater to the need of almost all kinds of customers.

Transparency:

Transparency is one of the key features of ULIPs. Unlike other investment tools, ULIPs offer high flexibility to customers and hence they control their ULIP policies to a good extent. Clear benefits and features, illustrative brochures and free-look period make sure that customers are doubly sure before they start investing in their ULIP schemes.

Liquidity:

ULIP schemes offer liquidity to customers depending upon the insurance provider from which they have been availed. Most insurance companies offer a lock-in period of three or five years after which customers are free to make either full or partial withdrawals.

Multiple Benefits out of a Single Scheme:

The best feature of ULIPs is that these policies offer not juts insurance benefit but also an avenue for people to grow their money through investment in shares and funds. This investment tool is ideal for customers who have a lower risk appetite but want to grow their money, nonetheless.

Tax Benefits:

ULIPs offer not only protection and returns but also tax exemption under section 80C of the Income Tax Act for life insurance and health insurance plans and under section 80D for life insurance and critical illness riders. Also, ULIPs are a great way to save in a disciplined way and to also ensure growth of the saved amount.

Risk mitigation:

Since ULIPs invest money in various funds and also offer protection, these products are low-risk investment tools. These policies are great for customers who wish to avail the advantage of market growth without actually participating in the stock market.

Death and Maturity Benefits:

Following are the death and maturity benefits associated with ULIPs. These benefits are central to any ULIP policy irrespective of the insurance provider the scheme is availed from. The benefits may however, slightly differ from one insurance company to another.

- Death Benefits: Death benefits of ULIPs are offered in case of unfortunate demise of the policyholder. Generally, death benefit is equal to the sum assured plus fund value. However, depending upon the cause of death (accidental or natural) death benefits may vary.

- Maturity Benefits: Maturity benefits are offered to policyholders when the policyholder survives beyond the maturity period. Maturity benefits are equal to the amount of fund value. However, certain insurance companies may offer additional benefits subject to policy terms and conditions.

Comparison of Best ULIP Plans in India

ULIP Plan Name | Eligibility & Premium Details | Charges & Switches |

Aegon Life iMaximise Secure Plan | Entry Age: 7–55 years Minimum Premium: ₹24,000–₹36,000 Allocation Charges: NIL | Admin Charges: ₹100/month Free Switches: 4 |

Bajaj Allianz Future Gain | Entry Age: 1–60 years Minimum Premium: ₹25,000 Allocation Charges: 0%–1.5% | Admin Charges: ₹33.33/month Free Switches: Unlimited |

Aviva Life Bond Advantage Plan | Entry Age: 2–65 years Minimum Premium: ₹50,000 Allocation Charges: NA | Admin Charges: ₹40/month Free Switches: 12 |

Bajaj Goal Assure | Entry Age: 0–60 years Minimum Premium: ₹3,000–₹36,000 Allocation Charges: NIL | Admin Charges: ₹400/year (5% increase annually) Free Switches: Unlimited |

Birla Sun Life Wealth Assure ULIP | Entry Age: 30–65 years Minimum Premium: ₹1,00,000/year Allocation Charges: 5% of basic premium | Admin Charges: ₹3,000/year (first 5 years) Free Switches: NA |

Edelweiss Tokio Wealth Enhancement (Ace) | Entry Age: 5–65 years Minimum Premium: ₹75,000 Allocation Charges: 3%, 2%, 1% | Admin Charges: ₹40/month Free Switches: Unlimited |

Kotak Single Invest Plus | Entry Age: 18–55 years Minimum Premium: ₹3,00,000 Allocation Charges: 5%, 4% | Admin Charges: ₹500/month Free Switches: 12 |

MAX Life Fast Track Growth Fund | Entry Age: 18–55 years Minimum Premium: ₹25,000–₹1,00,000 Allocation Charges: 2% | Admin Charges: ₹1,500/year Free Switches: 12 |

LIC Market Plus-I Growth Fund | Entry Age: 18–65 years Minimum Premium: ₹5,000–₹30,000 Allocation Charges: 0.033% | Admin Charges: ₹60/month Free Switches: 4 |

What Types of Funds Do ULIPs Offer?

ULIPs offer a wide range of fund options that policyholders can invest in. the funds can be categorised into low-risk funds, medium-risk funds and high-risk funds. The different types of funds offered are mentioned below:

Cash funds: Cash funds, also known as money market funds, are mutual funds that provide a safe and easily accessible avenue to invest. These funds are generally low-risk, low return funds.

Balanced funds: Balanced funds combine equity and fixed interest instruments. By virtue of the fixed interest component, the funds combine safety with capital appreciation (through the equity fund component). These funds maintain a balance of stock and bond options, resulting in guaranteed returns, with the bonds offsetting the potential risks of equity investments. These funds are categorised as medium-risk.

Income, fixed interest and bond funds: These funds are generally invested in corporate bonds, debt funds, government securities and allied fixed income instruments. With their mix of secured and unsecured investments, these funds provide policyholders with a moderate percentage in terms of returns and have an elevated risk factor.

Equity funds: Equity funds are invested in company stocks. The aim of equities is to generate capital appreciation, making these high-risk investments.

Debt Funds: Income, Fixed Interest and Bond Funds, which fall under the category of medium risk, invest in debt assets like corporate bonds, government securities, and other low-risk fixed income products. In contrast to equity, the returns are lower, but the risk is also lower. These funds offer somewhat better returns than cash funds.

How to Choose a ULIP?

When choosing ULIPs, policyholders should keep the following points in mind so they receive the maximum returns based on their risk handling capacity:

- Based on personal investment goals: Most policyholders choose ULIPs to meet personal investment goals, such as funding a child’s education, retirement planning, building a corpus of funds etc. Depending on the investment goal, select the type of ULIP scheme that best suits the achievement of that goal.

- Compare ULIP offerings: After ascertaining the goal and the type of ULIP that will achieve it, compare the ULIP offerings in the market. Focus on expenses, premium payments and ULIP performance. Look at the mix of shares, bonds and equities the ULIP invests in to get a broad picture of the security and returns possible from such a scheme.

- Policy term flexibility: When choosing a ULIP, check if the selected policies offer flexibility in terms of benefits. Depending on the duration of the investment policy, look at short, medium or long term ULIPs.

- Investment flexibility: Look for ULIPs that allow for investments across classes, from bonds to stocks to equities. This will result in higher returns and permit high-risk investments when the market is up even if the initial investment was low-risk.

ULIP Eligibility Criteria:

The eligibility criteria for ULIPs are mentioned below:

- Should meet the criteria for entry age (depends on the insurer and policy type).

- Should be below the maximum entry age (depends on the insurer and policy type).

- Should be able to make the premium payments as per the policy selected.

Key Terms Related to ULIPs

- Policy Term: The period of coverage offered by an insurance policy is known as the policy term of that policy.

- Premium Payment Term: Premium payment term of an insurance policy is defined as the term for which customers are required to pay premiums. For example, if you avail a life insurance ULIP for six years and are required to pay annual premiums every year, then the premium payment term in this case becomes six years.

- Premium Payment Mode: Most ULIP policies allow online payments for premium. Premium payment mode is defined as the mode which is used to make premium payment for insurance schemes.

- Partial withdrawals: Partial withdrawals refer to the act of withdrawing a part of your invested money once a certain time has elapsed.

- Sum assured: Sum assured for a ULIP is the amount of money that you are sure to get at the end of the policy period.

- Fund Value: Fund value of a ULIP can be described as the total value of the funds that you hold at any point of time.

- Death Benefit: Death benefit of an insurance policy is defined as the sum paid out to policyholder’s nominee in the unfortunate event of his/her death.

- Maturity Benefit: Maturity benefit is the sum paid out to the policyholder when the policy term is over.

- Loyalty additions: Loyalty additions are any sum or perks added to a policyholder’s account by insurance providers as a token of steady insurance relationship of customers.

- Free-look period: Free-look period is generally a 15 or 30 day period which customers can take to understand fully the terms and benefits of ULIPs. Customers are free to return their policy within this time period if they are not happy with the ULIP terms and benefits.

Types of Unit Linked Insurance Plans :

Unit linked insurance plans can be classified into various types depending upon the parameter that is being taken as the basis.

On the basis of funds that ULIPs invest in:

Based on the type of fund a ULIP invests in, ULIPs can be divided into the following three types –

- Equity Funds: These are ULIP schemes that use the premium you pay to invest it partly in equity funds. The risk ratio for these is higher since an active linkage to stock market.

- Balanced funds: As the name itself signifies, this is a ULIP that strives to strike a balance between debt funds and stock market so as to minimize risk for customers and enhance returns.

- Debt Funds: This type of ULIP invests customers’ money in debt instruments such as bonds, where the risk is lower but the subsequent returns are low too.

On the basis of end use of funds

- For retirement planning: These ULIPs are offered for customers who want to plan their retirement earnings by paying premiums while they are employed.

- For child education: These ULIPs offer benefits for your child’s education. These benefits include rolling out money at key education milestones of your children and also ensuring their education expenses are paid in case of some unforeseen circumstances take place.

- For wealth creation: ULIPs meant for wealth creation help customers invest and save their money so that they have a good corpus at any particular point of time.

- For medical benefits: ULIPs like these are aimed at providing financial assistance at times of medical emergencies. Special riders can be availed for protection against major illnesses or critical illnesses.

Types of ULIPs Based on Death Benefit

- Type I ULIP: Type I ULIP plans pay higher of the assured sum value or the fund value to the nominee in case of death of the policyholder.

- Type II ULIP: Type II ULIP plans pay the assured sum value plus the fund value to the nominee in case of death of the policyholder.

ULIP Charges and Premium Calculation

Whenever a customer avails a ULIP scheme, following are the charges that come into play at some point of the policy period.

- Fund management charges: This charge is for the management of fund and is levied as a percentage of the value of assets. This fee is charged by the insurance companies before arriving at the net asset value.

- Discontinuation charges: This charge is borne by the customer in case he/she decides to discontinue with the ULIP scheme even before the lock-in period of 3 or 5 years.

- Mortality charges: Mortality charge is generally charged on a monthly basis and is for compensating the insurance company in case a policyholder does not live to the assumed age. These charges differ according to the lifestyle and age of policyholders.

- Surrender charges: A surrender charge is levied in case of premature full or partial withdrawal of units.

- Premium allocation charges: This charge is levied to compensate for the expense incurred towards issuing of policy which involves distributor fee and cost of underwriting of funds.

- Policy administrative charges: Policy administrative charges, as the name indicates, are aimed at recovering money that goes into maintaining the ULIP policies. This involves cost of paperwork, premium intimation etc.

- Fund switching charges: ULIPs provide flexibility to choose fund option as well as switch between them in case you want. A fee for switching is charged for switching your fund type.

ULIP Plan Calculator:

To enable policyholders to calculate their premiums and check the returns due to them, a number of insurance providers have made arrangement for a calculator. This tool calculates the returns the policyholder stands to receive for a particular ULIP by inputting the specific policy as well as the time period of that policy.

Some ULIP plan calculators also allow a comparison between ULIPs, calculating the returns each will provide for the time period specified, allowing the policyholder to choose the one that best fits with their requirements.

ULIP Riders:

Riders are additional coverage benefits that can be added to an existing policy to enhance the protection offered. Riders offer coverage over and above that offered by the policy and are an optional add-on.

Policyholders choose riders based on their requirement and need, and the riders have been designed with these in mind.

The various types of riders offered are mentioned below:

- Accidental Death/Permanent Disability Benefit Rider: This rider provides the policyholder with cover in the event of an accident being the cause of death. The policyholder’s beneficiaries receive the additional benefit in case of such an occurrence.

- Critical Illness Rider: This rider provides the policyholder with financial assistance in the event he/she is diagnosed with a critical illness as defined by the rider.

- Term rider: This rider provides the policyholder with a monthly income to the policyholder’s beneficiary in the event of the policyholder’s death.

- Waiver of monthly premium: this rider offers the policyholder a waiver from premium payment if he/she meets with an accident as covered under the rider.

ULIPs vs Mutual Funds:

ULIPs and mutual funds have long been considered two of the better performing assets to growth wealth. A cursory search provides a number of differing opinions on which of these is a better option. Given below is a comparison of the two:

ULIPs | Mutual Funds |

ULIPs offer both investment as well as insurance. | Mutual funds offer good investment opportunities. |

ULIPs are generally long term plans. | Mutual funds are short and medium term investment opportunities. |

ULIPs allow for switching between funds, mitigating the risk. | No switches are allowed, with exit the only option to offset the risk. |

ULIPs offer limited liquidity. | Mutual funds can be liquidated very easily. |

ULIPs offer tax benefits (under Section 80 C). | Only tax saving investments offer any sort of tax benefit. |

Reasons Why ULIPs are a Good Choice

Given below are the reasons why ULIPs are good choice:

- Transparent structure, charges, and features

- In cover option

- Provides flexibility in switching to different funds

- Tax benefits under Section 80C, 80D, and 10(10D)

- Frequencies in paying different premiums

- Different rider options

Steps to Buy a ULIP Plan Online

The following are the steps to buy a ULIP plan online:

- Visit the official website of the insurance company.

- Select your ULIP plan that you are interested in Select your policy tenure and premium payment tenure.

- Click on ‘Proceed’ for completing the payment procedure.

- You can select the monthly, half yearly, and yearly mode of payment.

- The payment can be made through debit card, credit card, online wallet, or net banking.

Why Should You Invest in a ULIP Plan?

The following are the reasons why you should invest in ULIP schemes:

- Multiple options: ULIPs offers multiple investment options starting from high to low risk fund and debt to equity fund.

- Offers high returns: Due to the availability of multiple investment options, it offers 12% to 15% in just 10 years.

- Ensures transparency in the process: ULIPs are seamless and transparent and hence is one of the safest and best investment options.

- Plans can be surrendered at low charges: Compared to traditional plans ULIPs charges low surrendered cost on the plan.

- Easy liquidation of fund: ULIPs enable investors to withdraw a certain sum of money to fulfil specific financial requirements or meet certain fiscal emergencies or unpredictable events.

ULIP Plans by Top Insurance Providers

The following is the list of top insurance companies offers ULIP Plans:

Large Cap | Mid Cap | Balanced / Debt |

TATA AIA Life Insurance Top 200 Fund | TATA AIA Whole Life Mid Cap Equity Fund | IDBI Federal Life Insurance Cautious Asset Allocator Fund |

LIC Growth Fund | Aditya Birla Multiplier | AVIVA Life Insurance Balanced Fund-II |

TATA AIA Super Select Equity Fund | MAX Life Insurance High Growth Fund | Aditya Birla Capital Enhancer |

PNB MetLife Virtue II | IDBI Federal Insurance Midcap Fund | Future Generali Future Balance Fund |

Bharti AXA Growth Opportunities Plus Fund | Bajaj Allianz Accelerator Mid-Cap Fund II | Edelweiss Tokio Managed Fund |

Aditya Birla Capital Pure Equity | PNB MetLife Flexi Cap | Canara HSBC OBC Life Insurance Balanced Plus Fund |

Bajaj Allianz Pure Stock Fund | HDFC Life Opportunities Fund | ICICI Prudential Multi Cap Balanced Fund |

Bharti AXA Grow Money Plus Fund | ICICI Prudential Opportunity Fund | PNB MetLife Balancer II |

Bharti AXA Build India Fund | Kotak Life Classic Opportunities Fund | AEGON Life Stable Fund |

TATA AIA Large Cap Equity Fund | – | LIC Balanced Fund |

Kotak Life Frontline Equity Fund | – | Aditya Birla Capital Creator |

Edelweiss TOKIO Equity Top 250 Fund | – | TATA AIA Life Insurance Whole Life Stable Growth Fund |

Bajaj Allianz Equity Growth Fund II | – | Aditya Birla Capital Income Advantage |

HDFC Life Blue Chip Fund | – | IDBI Federal Life Insurance Pure Fund |

TATA AIA Whole Life Aggressive Growth Fund | – | Aditya Birla Capital Protector |

TATA AIA Top 50 Fund | – | Aditya Birla Capital Builder |

Future Generali Future Apex Fund | – | TATA AIA Life Insurance Whole Life Income Fund |

Aditya Birla Maximiser | – | Edelweiss Tokio Bond Fund |

Aditya Birla Super 20 | – | Kotak Life Dynamic Bond Fund |

Aviva Life Insurance Enhancer Fund-II | – | MAX Life Insurance Secure Fund |

AEGONLife Accelerator Fund | – | Bharti AXA Steady Money Fund |

SBI Life Equity Fund | – | ICICI Prudential Income Fund |

Edelweiss TOKIO Equity Large Cap Fund | – | Canara HSBC OBC Life Insurance Debt Fund |

MAX Life Insurance Growth Super Fund | – | Kotak Life Dynamic Gilt Fund |

ICICI Prudential Bluechip Fund | – | Aditya Birla Capital Assure |

ICICI Prudential Maximiser Fund V | – | SBI Life Money Market Fund |

Aditya Birla Capital Magnifier | – | TATA AIA Life Insurance Whole Life Short-Term Fixed Income Fund |

Bajaj Allianz Bluechip Equity Fund | – | Kotak Life Dynamic Floating Rate Fund |

Canara HSBC OBC Growth Plus Fund | – | PNB MetLife Protector II |

Canara HSBC OBC Equity II Fund | – | Future Generali Future Income Fund |

ICICI Prudential Multi Cap Growth Fund | – | Bharti AXA Safe Money Fund |

Aditya Birla Capital Value & Momentum | – | PNB MetLife Preserver II |

Future Generali Future Maximize Fund | – | AVIVA Life Insurance Bond Fund-II |

Future Generali Future Opportunity Fund | – | Aditya Birla Capital Liquid Plus |

– | – | HDFC Life Liquid Fund |

Key Takeaways:

- ULIPs offer investment flexibility across various asset classes but come with higher risk and charges. They are ideal for long-term goals and provide tax efficiency under Section 80C and 10(10D).

- ELSS funds are suitable for those seeking higher returns in a shorter lock-in period but come with moderate risk and taxation on gains above ₹1 lakh.

- PPF is the safest option with guaranteed returns and full tax exemption, making it ideal for risk-averse investors with long-term goals.

Investors should select an option based on their risk appetite, investment horizon

Risks Involved with ULIPs

Meanwhile, the hazards involved in Unit Linked Insurance Plans, or ULIPs, may vary depending on the type of fund attached to the program.

- Equity Funds: Higher market volatility makes it more risky.

- Debt Funds: Littler chance when compared with equity funds.

- Balanced Funds: Sharing risk in equity and debt portfolios thus moderate level of risk.

ULIP, in general, is riskier, relative to many other investments such as Mutual Funds and Equity Linked Savings Schemes (ELSS), and tends to be more diversified, but less volatile.

Comparatively, ULIPs are more risky than pure insurance policies or mutual fund investments. In case of ULIPs, the cost structure makes them more hazardous through the additional fee and costs associated with them, making it difficult for an investor to earn returns that are not only enough to cover these costs but also offer significant gains, thus further raising the overall risks.

Tax Benefits of ULIPs

The tax benefits you can avail on using a ULIP scheme are given below:

- Subsection 80C of the Income Tax Act assigns a tax deduction of Rs.150,000 every year for investments made in ULIPs.

- Returns are not liable to income tax if the conditions of the contract are met when maturity phase.

Pros and Cons of ULIPs

Pros

- Prospective benefits: After purchase the ULIPs, a person needs not feel liquidity pressure when it comes to decisions like buying a house, paying for education or marriage, saving enough funds for post-retirement life, etc. rather, all these decisions often are of lifelong security value.

- Flexibility in changing funds: All ULIPs split money in different funds for equalization and quite flexible regarding changing from debt, equity, and in combination.

- Tax benefits: It enjoys the dual-specific benefit, already mentioned-in Section 80C and also in Section 10(10D) for tax-free returns.

Cons

- Lower overall value: The period during which, two investments in individualized insurance and mutual fund are made together would generally offer a relatively healthier result when compared with opting for a ULIP, in spite of all the charges.

- High charges: Premium allocation charges, as well as the charges for fund management, represent the bulk of the total charge imposed by the investment on the prospective returns.

- Highly Volatile: It exhibits a heightened volatility as brought on by the equities with which the ULIPs are making their investment, aligning with the equity market in terms of the risks involved.

It is imperative that investors take due considerations, weighing both the risks and benefits and taking note of the costs as well. This is particularly achieved by assessing individual financial goals, risk tolerance, and the investment horizon at their disposal before making a call.

Key Considerations Before Selecting a ULIP

In choosing anything, such as a Unit Linked Insurance Plan (ULIP), one really needs to understand all the areas of concerns as well as the pros as you would before investing in any other instrument. The major lookout points may be as below:

- Financial Status and Objectives: Calculate existing availability of funds and internally define the goals which one expects out of the investment. For the long-term goals, liquidity is not a problem, mostly long-term investment in the retirement planning or education funding. Ulips are a perfect fit here. The goals that require premature withdrawal should never be funded through Ulips as the charges levied on them are for premature redemption, which negates possible gains yield and even may be translated to losses.

- Risk appetite: Understanding one's risk appetite is the key to choosing an appropriate ULIP. Depending on risk perception, choose from either of the below Ulip lines. Invest in nature-related equity funds if your risk appetite can tolerate a higher level of risk for potential high returns. Choose moderately risk-friendly tools if you are more conservative with debt-holding strategy in your Ulips that offer economic but at lower-risk-return.

- Costs and Affordability: There are a number of charges that one must find out about for a ULIP, such as the premium allocation fee, fund management charges, and the mortality charges. Study the distribution of the costs in a more practical way to help in relating the funding with your available financial capacities and returns from the investment.

By using the past factors one can take an informed decision and select such a policy consumed against him to meet the financial objectives and risk appetite.

FAQs on ULIP Plan

- Will I get guaranteed returns on my ULIP investment?

Any investment made directly or indirectly in the stock market is not sure to offer returns. Returns depend upon the performance of the fund that customer’s money is invested in.

- Can I get my premiums back if I am dissatisfied with a ULIP policy?

Any refund of premiums is applicable only within 15 days of receipt of policy document. However, insurance companies might deduct a part of the premium as various fees and charges before reimbursing the amount.

- What is the maximum free-look period for ULIPs?

Most insurance companies offer a free-look period of 30 days to customers.

- How much of my premium is invested in units?

Some part of your premium goes into unit investment. This depends upon the type of ULIP product and varies from company to company.

- Can I switch my investment fund choice after availing ULIP?

Yes. Customers can freely switch between funds as per their wish and convenience. However, a certain switching charge is applicable and levied by insurance companies.

- Can I invest more than the regular premium?

Yes. Top-up facility is available and is subject to features of the ULIP scheme that you have availed

- Do insurance providers furnish comprehensive information about my ULIP scheme?

Yes. Insurance providers are expected to furnish annual reports, market scenarios and other fund related analysis and risk control measures to customers.

- Can I make a partial withdrawal from my ULIP?

There are no partial withdrawals allowed for pension and annuity plans. For other plans, a partial withdrawal is generally allowed from the 5th year onwards.

- Do ULIPs guarantee investment returns?

As per a directive, all ULIPs offer guaranteed returns as laid down by IRDA. The returns are payable upon the ULIP’s maturity.

- What percentage of the premium is allocated towards buying units?

The entire premium amount is used to buy units. The quantum of units bought depends on the ULIP and the year.

- What are the charges associated with a ULIP?

ULIPs usually charge a premium allocation charge and a mortality charge.

- What is a mortality charge?

A mortality charge is levied on ULIPs to cover the cost of insurance. The charges vary depending on the coverage type, age of the policyholder, health etc.

- Is there a penalty if I stop paying the premium?

If you fail to pay the premium within the first 3 years of the policy, insurance cover is immediately discontinued. For premiums not paid after 3 years, the surrender value is paid and the contract is terminated.

- How is the fund value calculated?

The fund value is calculated by multiplying the total number of units in the policy with the Net Asset Value.

- What is Net Asset Value?

The Net Asset Value (NAV) is the price of units in a fund. The NAV is calculated in Rupees.

- What is a regular premium policy?

A regular premium policy is one where the premium is paid throughout the policy term. Payments can be made monthly, quarterly, half-yearly or annually, depending on the policy.

- Can I surrender my ULIP?

Yes, as per an IRDA directive, ULIPs can be surrendered upon payment of a surrender charge.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.