Standard Chartered Bank IFSC code & MICR code

State wise list of Standard Chartered Bank IFSC code & MICR code.

Search for IFSC/MICR codes

or Choose State from list below

Standard Chartered Bank (SCB) IFSC Code

Since the government introduced electronic transfer of funds through NEFT (National Electronics Fund Transfer) and RTGS (Real Time Gross Settlement), the way we transfer funds in India has been changed drastically. No more complicated paperwork and long periods of wait.

NEFT and RTGS has made financial transactions simple, fast and transparent. Both these methods make use of IFSC Code or MICR Code. It is possible to transfer any amount of money from any NEFT/RTGS enabled bank to a beneficiary who has an account in any other NEFT/RTGS enabled bank throughout the country. MICR Code (Magnetic Ink Character Recognition Code) is used for both domestic and international transactions. These unique codes was introduced by RBI to ensure enhanced speed, efficiency, security and accuracy while your money is transferred. Chances of fraud are also diminished because of these codes.

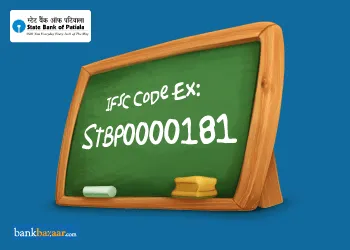

IFSC (Indian Financial System code) consists of 11 characters with both alphabets and numbers. Each branch of banks in India are assigned a unique IFSC. It consists of three parts:

- The first four characters are alphabets and represent the name of the bank.

- This is followed by the digit '0' which is there for future use.

- The final six characters are usually numbers and indicate a particular branch.

For example, here is a breakup of the IFSC code of branch of Standard Chartered Bank:

SCBL0036097 - IFSC Code for a Standard Chartered Bank branch:

- First four alphabets - SCBL - indicates the name of the bank (in this case Standard Chartered Bank)

- 0 - For future use

- 036097 - Indicates a particular branch of Standard Chartered Branch

How to Search for Standard Chartered Bank IFSC and MICR Code?

Standard Chartered Bank branches are NEFT and RTGS enabled, which means their customers can transfer funds electronically using these methods. Customers need to simply fill out the relevant form filling in details of the beneficiary account including the IFSC. The IFSC and MICR code can be found printed on a cheque book issued by the particular branch of Standard Chartered bank. It can also be found easily online. You can find IFSC on the official website of Standard Chartered, on the official website of Reserve Bank of India or on a third party financial website like BankBazaar.

If you decide to visit BankBazaar to find the codes, you will be presented with a complete list of IFSC codes for almost every bank, including that of Standard Chartered Bank. Following are the steps one should follow to get the IFSC or MICR codes that you require:

- Visit the BankBazaar website, scroll down the homepage, find the 'Bank IFSC Code' tab and click on it.

- This will open a second page where there will be a few drops down menus from which you will have to choose the ones that you are looking for.

- There will be a 'Select Bank' drop down option, which will show you a list of banks that you can choose from. You must click on the option 'Standard Chartered'.

- The other drop down options are for 'Select State', 'Select District' and 'Select Branch'. As soon as you select the options that you require, BankBazaar will generate the IFSC and MICR codes for that branch.

The generated table will also provide you with the phone number, address of the branch, branch code etc.

How to Transfer Money using Standard Chartered Bank NEFT and RTGS?

As a customer of Standard Chartered Bank one can make use of the NEFT and RTGS facility to transfer funds from any of the Standard Chartered Bank branches to any other bank branch around the country.

National Electronic Funds Transfer (NEFT)

The NEFT or National Electronic Funds Transfers works on Deferred Net Settlements. NEFT is meant for smaller amounts of transfer than RTGS. The transfers are settled in batches on an hourly schedule. As long as you have debited the amount within the time-frame that is stipulated by the bank, it will be credited to the beneficiary on the same day. If not, the amount will be credited on the following working day.

You will need the following information to use NEFT service at Standard Chartered Bank:

- The name of the receiver

- The name of the receiver's bank and branch

- The receiver's account number

- The IFSC code of the receiver's bank branch

- The amount to be transferred

Standard Chartered provides their customers with the unique opportunity of using NEFT completely free of cost.

Real Time Gross Settlement System (RTGS)

Real Time Gross Settlement System (RTGS) transfers funds on an individual basis which means that the clearance of funds are scheduled individually and not batch-wise. RTGS is one of the quickest and safest ways to transfer funds. Standard Chartered Bank ensures that all the transactions will be completed on the same day that the customer debits the fund, unless it has been done after the indicated time frame.

You will need the following information to use RTGS service at Standard Chartered Bank:

- The receiver's name

- The receiver's bank and branch name

- IFSC Code of the receiver's bank

- The transfer amount

- The receiver's account number

- A remark for the receiver, if any

RTGS facility can be used for free by Standard Chartered Bank customers.

About Standard Chartered Bank (SCB)

Standard Chartered Bank is a public Limited Company headquartered in London. In 1969 two banks ('The Chartered Bank of India, Australia and China' and 'Standard Bank of British South Africa') were merged to form the establishment 'Standard Chartered Bank'. The bank was established in 1969 in London. Today it has a network of over 1,200 branches and outlets (including subsidiaries, associates and joint ventures) across more than 70 countries. The establishment employs around 87,000 people. The bank operates in consumer, corporate and institutional banking as well as treasury services. Although the bank is based in UK, Standard Chartered does not conduct retail banking in the UK. Further, around 90% of its profits come from Africa, Asia and the Middle East. Standard Chartered Bank provides all solutions for all financial needs including Credit cards, Consumer banking, corporate banking, Investment banking, Mortgage loans, Private banking, Wealth management and much more.

Other Products from Standard Chartered Bank

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.